American small businesses are navigating uncertain waters. There are new opportunities provided by the tax benefits in the OBBBA. There will be integration of artificial intelligence into everything. There are also obstacles to navigate past, including potentially crippling tariffs and a potential recession. This macroeconomic uncertainty is forcing small businesses to become leaner, invest in technology and potentially diversify their products and services.

For many American small businesses, tariffs present the greatest concern. It is estimated that every American will have to pay an additional $3000 a year for the same products as a result of price hikes related to American tariffs. Many SMEs (small and medium enterprises) can’t raise prices or absorb additional expenses. Furthermore, retaliatory tariffs could close market access to critical parts of the supply chain or sales partners. Combined with interest rates that continue to remain high, businesses have to run lean.

At the same time, the recent OBBBA legislation did codify an important initiative from the first Trump Administration – Opportunity Zones. According to the Economic Innovation Group, the premise of the OZ incentive is to encourage private investment in low-income and high-poverty areas. For small businesses, the new version of the program provides incredible benefits to investors and SMEs in rural areas and blighted urban districts.

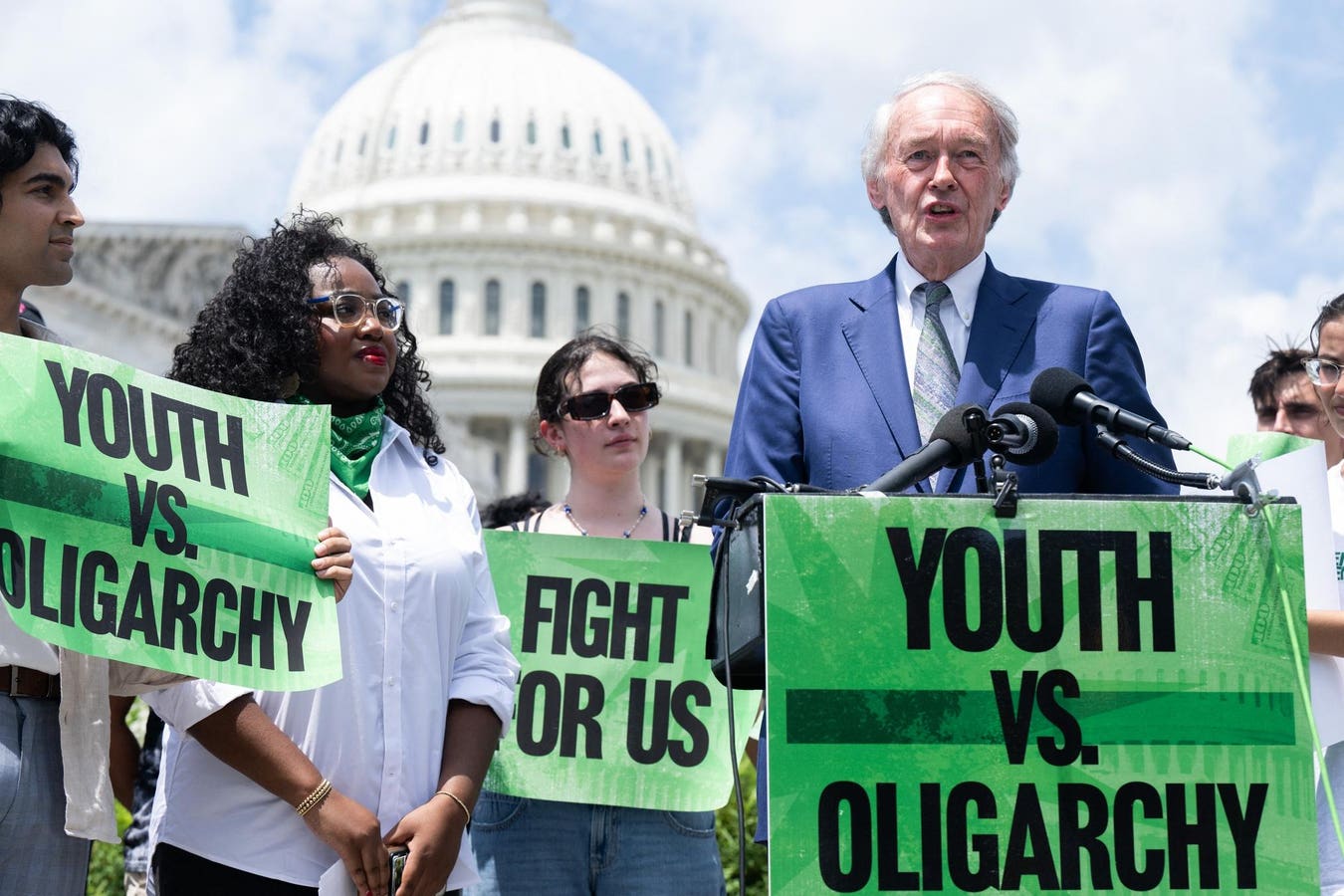

US Senator Edward Markey, Democrat of Massachusetts, speaks during a press conference on “Youth vs. … More

Far from Washington, DC, American small businesses are already investing in artificial intelligence. According to Bessemer Venture Partners and Bain Consulting, AI adoption is accelerating, with 60% of private companies reporting that AI is becoming a larger portion of their overall budgets – driven in large part by solutions developed for them by tech companies and other vendors. Large companies are switching to AI-based procurement systems, which will benefit small businesses. Even the adoption of the most mainstream AI tools, like ChatGPT, is improving SME performance in areas like proposal writing and marketing.

One company that has been helping SMEs for a long time to manage their IT operations and security is Electric. Founded in 2017, Electric supports SMEs in every aspect of their information technology needs, from procuring and provisioning new hardware to automating IT onboarding and offboarding, compliance, application permissions and cybersecurity. For growing SMEs and startups, the potential of companies like Electric could be game changing. Now, instead of allocating resources to a technology department, SMEs can shift those resources to more engineers or sales staff.

Electric represents an important trend in enterprise technology. Instead of multiple software and SaaS solutions, AI is allowing companies to develop more comprehensive solutions that can be used across verticals. Similarly, in a world of changing regulatory and compliance requirements, and sometimes dramatic changes, like in the United States, AI can more quickly keep companies updated and in compliance. Electric boasts hundreds of clients around the world who use its AI platform for mission critical tasks like security monitoring and compliance.

Ryan Denehy, CEO of Electric

Recently, Electric announced a partnership with Justworks, an HR technology solutions company, to create a partner API where clients can seamlessly integrate their Justworks and Electric accounts together. SMEs perennially under invest in HR departments. With the growth of remote work, HR departments are often tasked with IT-related tasks, such as securely buying, tracking, and retrieving laptops.

People-led teams often aren’t well-equipped to handle these tasks, but AI-driven startups like Electric and others can simplify, evaluate preferred pricing and integrate with existing workflows. In addition, HR departments are using AI for workforce planning across geography and skills sets. Lastly, SMEs are looking for integrated solutions, like the Electric and Justworks partnership, that allows them to more efficiently onboard and offboard employees, providing a better employee experience and less cost, while also getting access to cybersecurity solutions should they need it. For a small business with anywhere between 10-500 employees and only 1-2 IT and HR employees, these tasks can swallow up executives’ time and distract from mission-critical activities.

Suddenly, small businesses can act like medium-sized businesses. According to Qamar Saleem, Global Head of the SME Finance Forum at the International Finance Corporation (IFC), SME’s make up 90% of businesses in the world and generate nearly 70% of employment. Overall, SMEs contribute about 50% of the global GDP. Yet, the total global SME financing stands at just $4 trillion — a fraction compared to the $700 trillion global GDP. This gap symbolizes the urgent need for innovative, inclusive, and scalable finance solutions to support the backbone of our economies worldwide

According to Saleem and the World Bank, one of the biggest barriers for small businesses to secure financing is strong internal processes and management practices. With AI, and tools like Electric, SMEs become more bankable, efficient and cognizant of their operations.